-

×

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (394)

1 × රු1,450.00

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (394)

1 × රු1,450.00 -

×

Sisters of Sword and Song by Rebecca Ross (561)

1 × රු990.00

Sisters of Sword and Song by Rebecca Ross (561)

1 × රු990.00 -

×

Shatter Me by Tahereh Mafi (566)

1 × රු1,400.00

Shatter Me by Tahereh Mafi (566)

1 × රු1,400.00 -

×

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (398)

1 × රු1,450.00

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (398)

1 × රු1,450.00 -

×

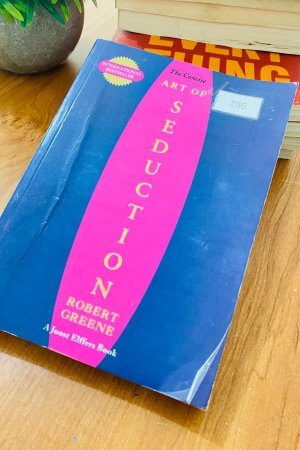

Concise Art of Seduction by Robert Greene – Master the Power of Influence (296)

1 × රු1,600.00

Concise Art of Seduction by Robert Greene – Master the Power of Influence (296)

1 × රු1,600.00 -

×

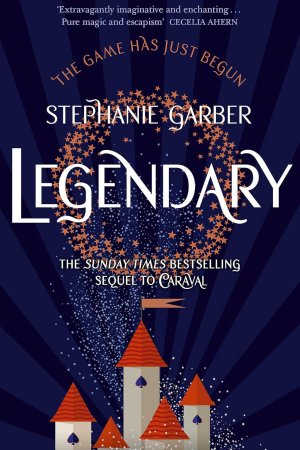

Legendary by Stephanie Garber

1 × රු4,150.00

Legendary by Stephanie Garber

1 × රු4,150.00

Subtotal: රු11,040.00

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (394)

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (394)  Sisters of Sword and Song by Rebecca Ross (561)

Sisters of Sword and Song by Rebecca Ross (561)  Shatter Me by Tahereh Mafi (566)

Shatter Me by Tahereh Mafi (566)  A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (398)

A Game of Retribution by Scarlett St. Clair Game of Retribution: Unleash Your Creativity - Transform Your Life with Creative Thinking (Paperback) (398)  Concise Art of Seduction by Robert Greene – Master the Power of Influence (296)

Concise Art of Seduction by Robert Greene – Master the Power of Influence (296)  Legendary by Stephanie Garber

Legendary by Stephanie Garber

Reviews

There are no reviews yet.