Subtotal: රු1,200.00

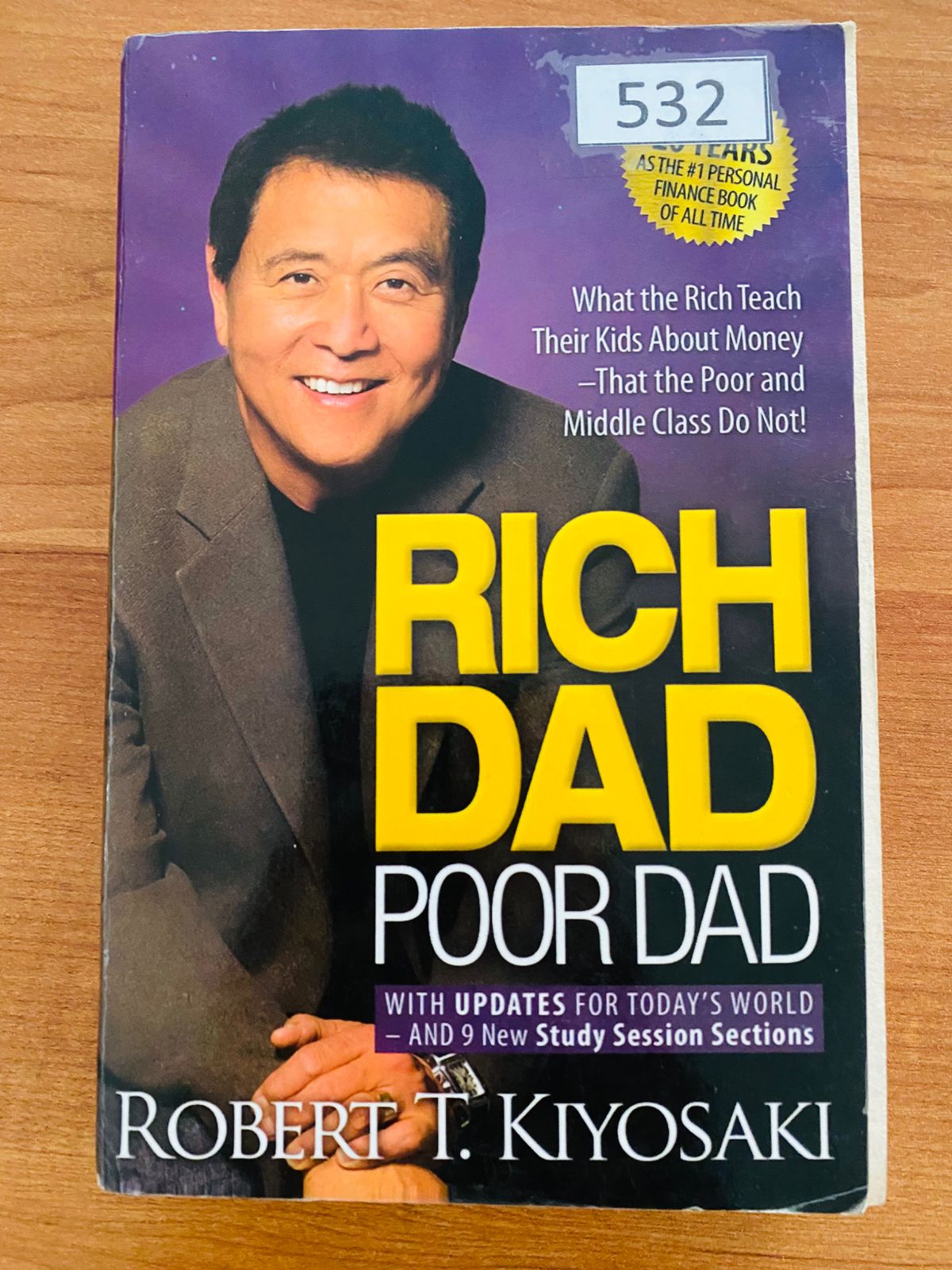

Rich Dad Poor Dad by Robert T. Kiyosaki (532)

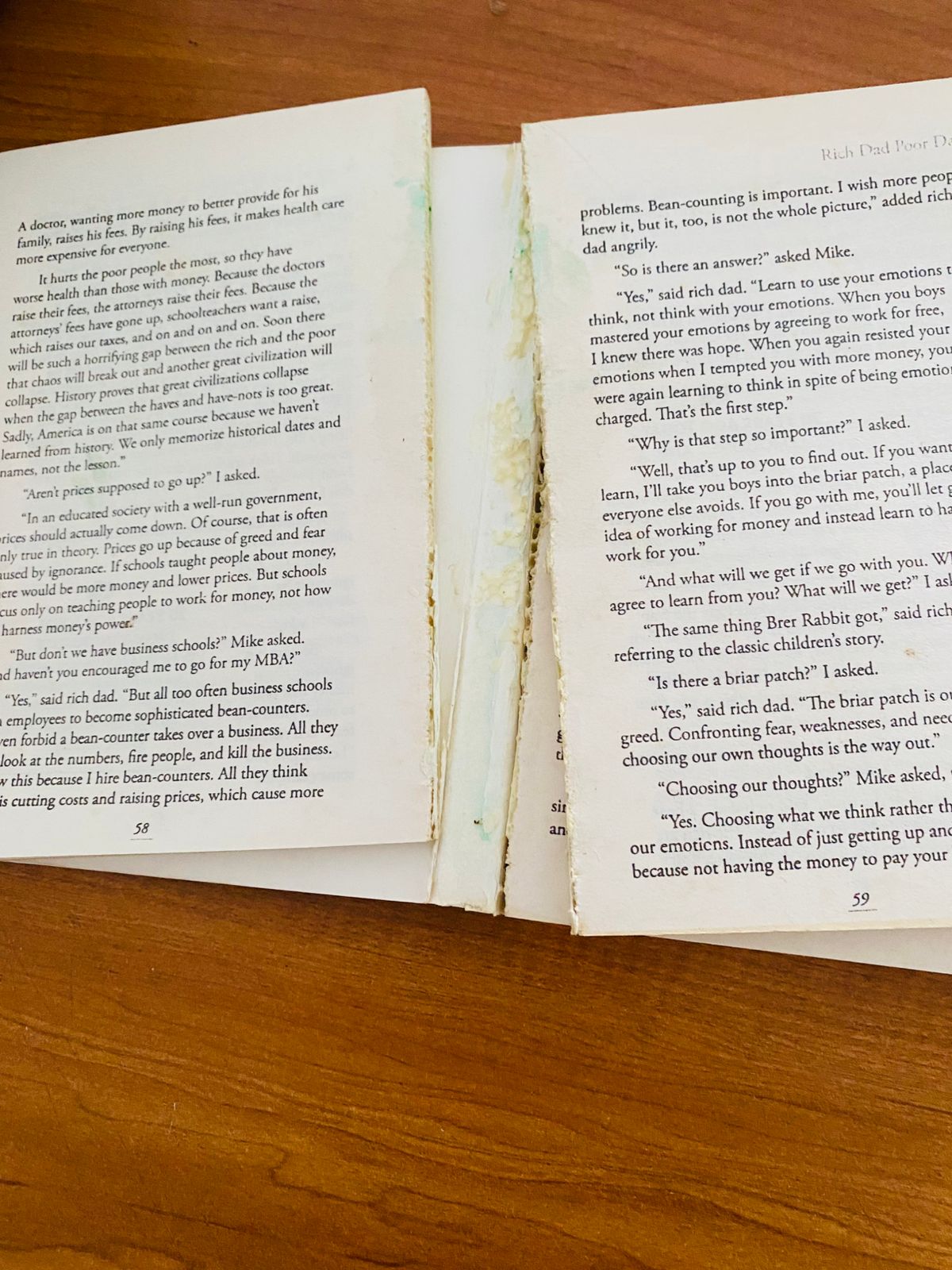

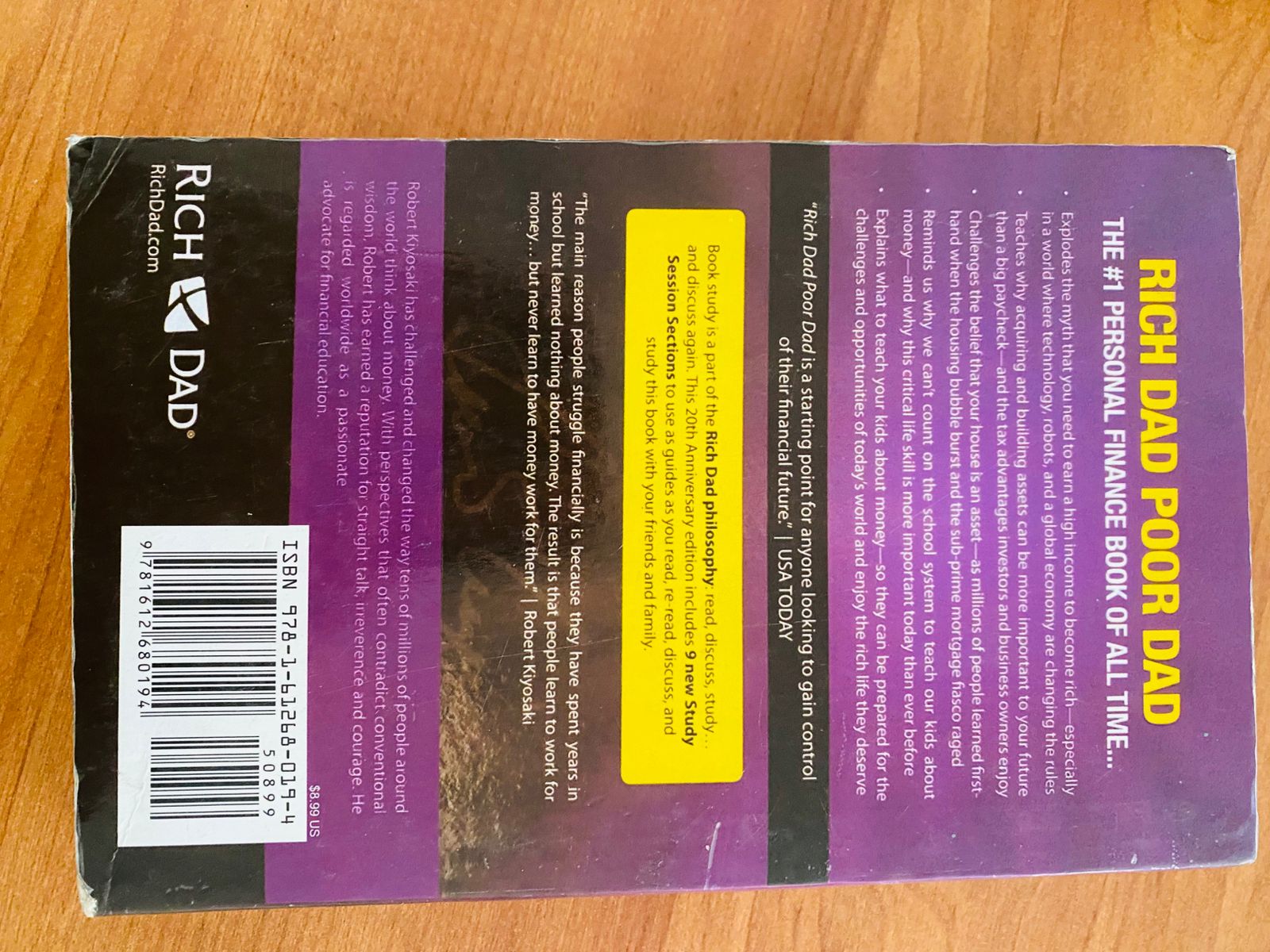

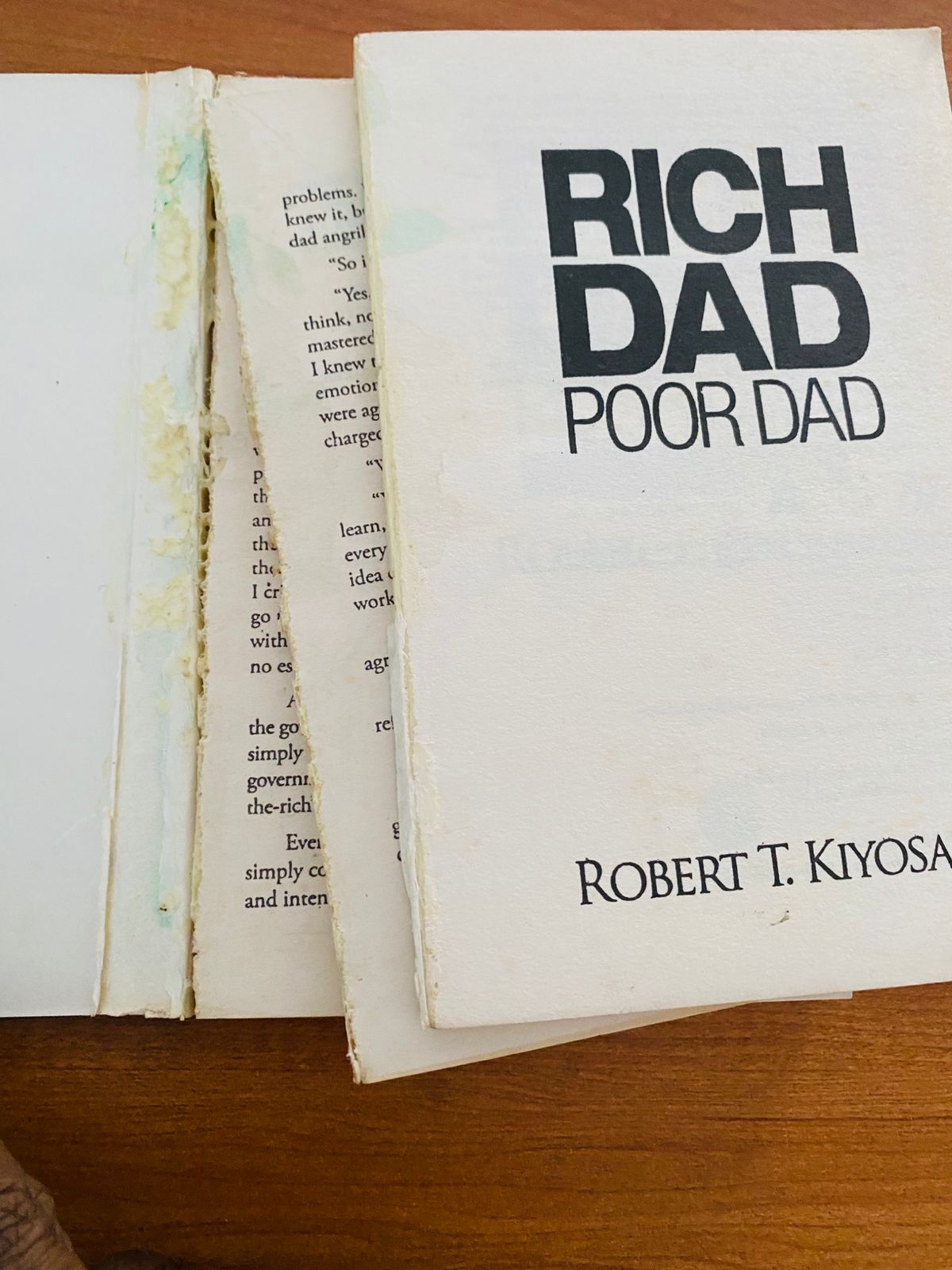

| Binding Issue |

1 in stock

Purchase & earn 6 points!

SKU: 532

Category: Damaged & Imperfect Books

Rich Dad Poor Dad by Robert T. Kiyosaki is one of the most influential personal finance books ever written. It challenges traditional beliefs about money, work, and education while teaching readers how to think differently about wealth and financial independence. Through simple storytelling and real-life lessons, the book explains why financial education is more important than earning a high salary.

The book is based on the contrasting philosophies of two father figures in the author’s life. The “Poor Dad” represents Robert Kiyosaki’s biological father, who was well-educated, hardworking, and financially struggling. The “Rich Dad” represents the father of Kiyosaki’s best friend, who lacked formal education but achieved financial success through business and investing. Rich Dad Poor Dad by Robert T. Kiyosaki uses these two perspectives to highlight how mindset and financial knowledge shape one’s future.

One of the core lessons of Rich Dad Poor Dad by Robert T. Kiyosaki is the difference between assets and liabilities. Kiyosaki explains that wealthy people focus on buying assets that generate income, such as businesses, investments, and real estate. Poor and middle-class individuals, on the other hand, often spend money on liabilities that take money out of their pockets, such as expensive homes and cars. This simple but powerful concept forms the foundation of financial freedom.

Another major theme in Rich Dad Poor Dad by Robert T. Kiyosaki is financial literacy. The book argues that schools do not teach students how money works. As a result, many people grow up working hard for money instead of learning how to make money work for them. Kiyosaki emphasizes the importance of understanding cash flow, investments, taxes, and accounting basics to build long-term wealth.

The book also discusses the role of fear and risk in financial decision-making. Kiyosaki explains that fear of losing money often prevents people from taking opportunities that could improve their financial situation. Rich Dad Poor Dad by Robert T. Kiyosaki encourages readers to view mistakes as learning experiences rather than failures. According to the author, successful people learn from losses and use them to grow stronger.

Another important lesson is the idea of working to learn, not just to earn. Kiyosaki suggests that instead of focusing solely on salary, individuals should seek jobs that teach valuable skills such as sales, communication, leadership, and investing. These skills, he argues, are essential for building wealth and independence.

Rich Dad Poor Dad by Robert T. Kiyosaki also explores how the wealthy legally minimize taxes through knowledge of the system. The book explains that understanding tax laws and business structures allows individuals to protect and grow their income more effectively. This section highlights the importance of education and strategy over hard work alone.

The writing style of Rich Dad Poor Dad by Robert T. Kiyosaki is simple, direct, and motivational. The concepts are explained using real-life examples and clear language, making the book accessible to beginners in personal finance. While some ideas challenge conventional advice, they encourage readers to question long-held beliefs about money and success.

The book’s impact goes beyond finances. It promotes confidence, independence, and responsibility for one’s financial future. Rich Dad Poor Dad by Robert T. Kiyosaki encourages readers to take control of their money instead of relying on job security, pensions, or external systems.

This book is ideal for readers interested in financial education, investing, entrepreneurship, and wealth-building mindset. Whether you are a student, employee, or business owner, the lessons in Rich Dad Poor Dad by Robert T. Kiyosaki provide a new perspective on money and success.

Overall, Rich Dad Poor Dad by Robert T. Kiyosaki is a powerful introduction to financial literacy. It teaches that wealth is built through mindset, education, and smart decision-making, not just hard work. The book continues to inspire millions of readers worldwide to rethink their approach to money and pursue financial freedom.

Be the first to review “Rich Dad Poor Dad by Robert T. Kiyosaki (532)” Cancel reply

Related products

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Atomic Habits by James Clear (274)

Atomic Habits by James Clear (274)

Reviews

There are no reviews yet.