Subtotal: රු2,150.00

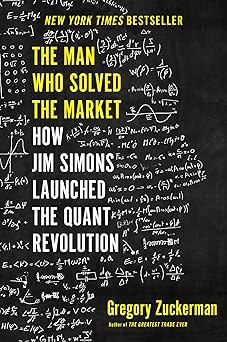

Man Who Solved the Market – Charanam Publication

The Man Who Solved the Market is a non-fiction finance book that explores quantitative investing, data-driven strategies, and disciplined decision-making in financial markets.

5 in stock

Purchase & earn 25 points!Introduction to The Man Who Solved the Market

The Man Who Solved the Market, published by Charanam Publication, is a compelling non-fiction book that explores the world of quantitative finance, data-driven investing, and mathematical problem-solving in financial markets. The book focuses on the idea that markets, often considered unpredictable, can be understood and navigated using logic, data analysis, and disciplined strategies.

Designed for readers interested in finance, trading, investing, and business intelligence, this book presents complex financial concepts in an accessible and engaging manner. It highlights how analytical thinking, persistence, and innovation can reshape traditional approaches to the stock market.

Understanding Quantitative Investing

One of the core themes of The Man Who Solved the Market is quantitative investing — a method that relies on mathematical models, algorithms, and statistical analysis rather than intuition or emotional decision-making. The book explains how data patterns, probabilities, and historical market behavior can be used to make informed investment decisions.

Readers are introduced to the mindset required to succeed in quantitative finance, where discipline, patience, and consistency are more important than short-term gains. The book emphasizes that successful investing is not about predicting the future perfectly, but about managing risk and probabilities over time.

The Role of Mathematics and Data

The book highlights the crucial role mathematics plays in understanding financial markets. Concepts such as probability, statistics, pattern recognition, and modeling are explained in a reader-friendly way. Rather than overwhelming the reader with formulas, the narrative focuses on how mathematical thinking changes the way one approaches market problems.

Data is presented as the foundation of modern investing. The book explains how large datasets, when analyzed correctly, can reveal inefficiencies in the market. These inefficiencies can then be used to build systematic strategies that operate consistently without emotional bias.

Discipline, Strategy, and Long-Term Thinking

A major lesson in The Man Who Solved the Market is the importance of discipline. The book stresses that even the best strategies fail if they are not followed consistently. Emotional reactions such as fear, greed, and overconfidence often lead investors to abandon sound systems.

The book encourages long-term thinking and process-oriented decision-making. Success is framed as the result of sticking to a well-tested system rather than reacting to short-term market noise. This mindset aligns closely with professional investing principles.

Risk Management and Market Reality

Risk management is a recurring theme throughout the book. The author explains that losses are inevitable in financial markets and should be expected as part of any strategy. What separates successful investors from unsuccessful ones is how they manage those losses.

The book teaches readers to define risk clearly, diversify intelligently, and accept uncertainty as a fundamental part of investing. This realistic approach helps build confidence based on preparation rather than hope.

Writing Style and Accessibility

The writing style of The Man Who Solved the Market is clear, structured, and educational. The book is suitable for readers with varying levels of financial knowledge, from beginners seeking an introduction to quantitative thinking to experienced investors looking to refine their mindset.

The tone remains informative rather than promotional, focusing on education and understanding rather than promises of quick profits.

Reader Suitability and Practical Value

This book is ideal for:

-

Finance and economics students

-

Stock market traders and investors

-

Business professionals

-

Readers interested in data science and analytics

-

Anyone seeking a logical, disciplined approach to investing

The lessons extend beyond finance, offering insights into problem-solving, decision-making, and strategic thinking applicable in business and life.

Indian Locally Published Edition

This edition is an Indian locally published copy. It contains the complete original content of the international edition, with no missing text or alterations. Any differences are limited to paper quality, cover finish, or printing style only. This makes the book more affordable and accessible for local readers while fully preserving the integrity of the original work.

Be the first to review “Man Who Solved the Market – Charanam Publication” Cancel reply

Related products

Non-fiction

Non-fiction

Non-fiction

Death by Sadhguru

Death by Sadhguru

Reviews

There are no reviews yet.