Subtotal: රු950.00

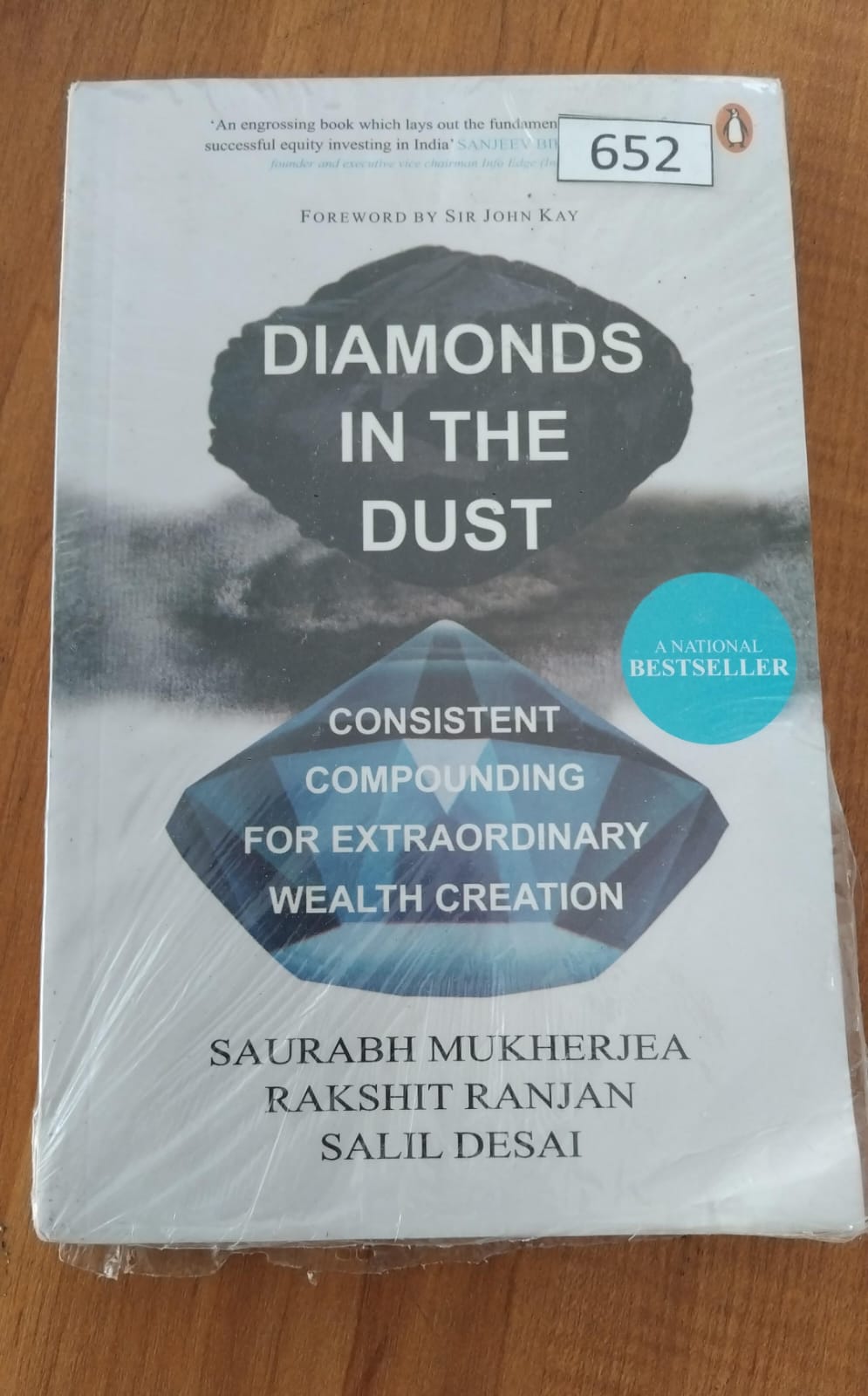

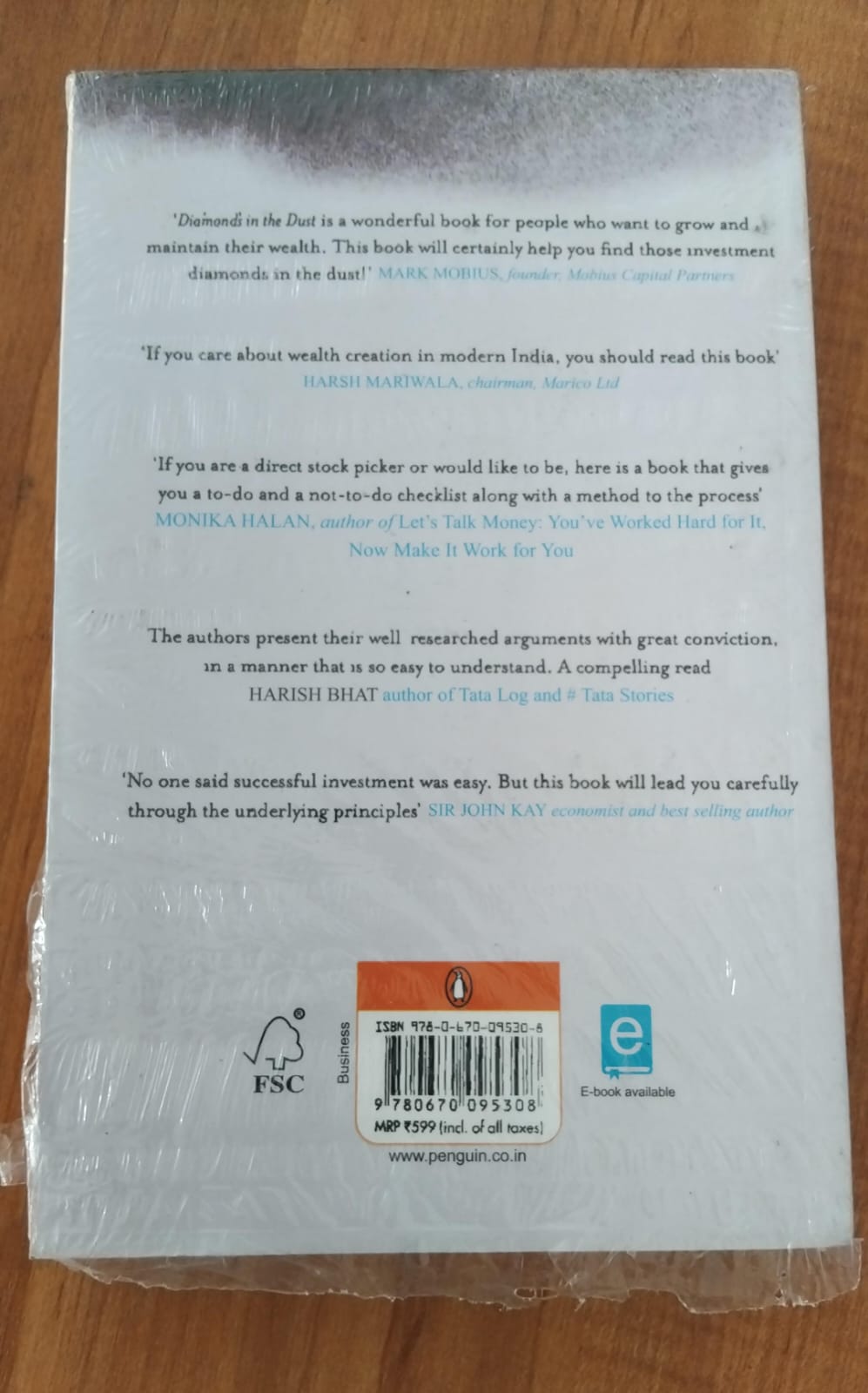

Diamonds in the Dust by Saurabh Mukherjea, Rakshit Ranjan & Salil Desai (652)

|

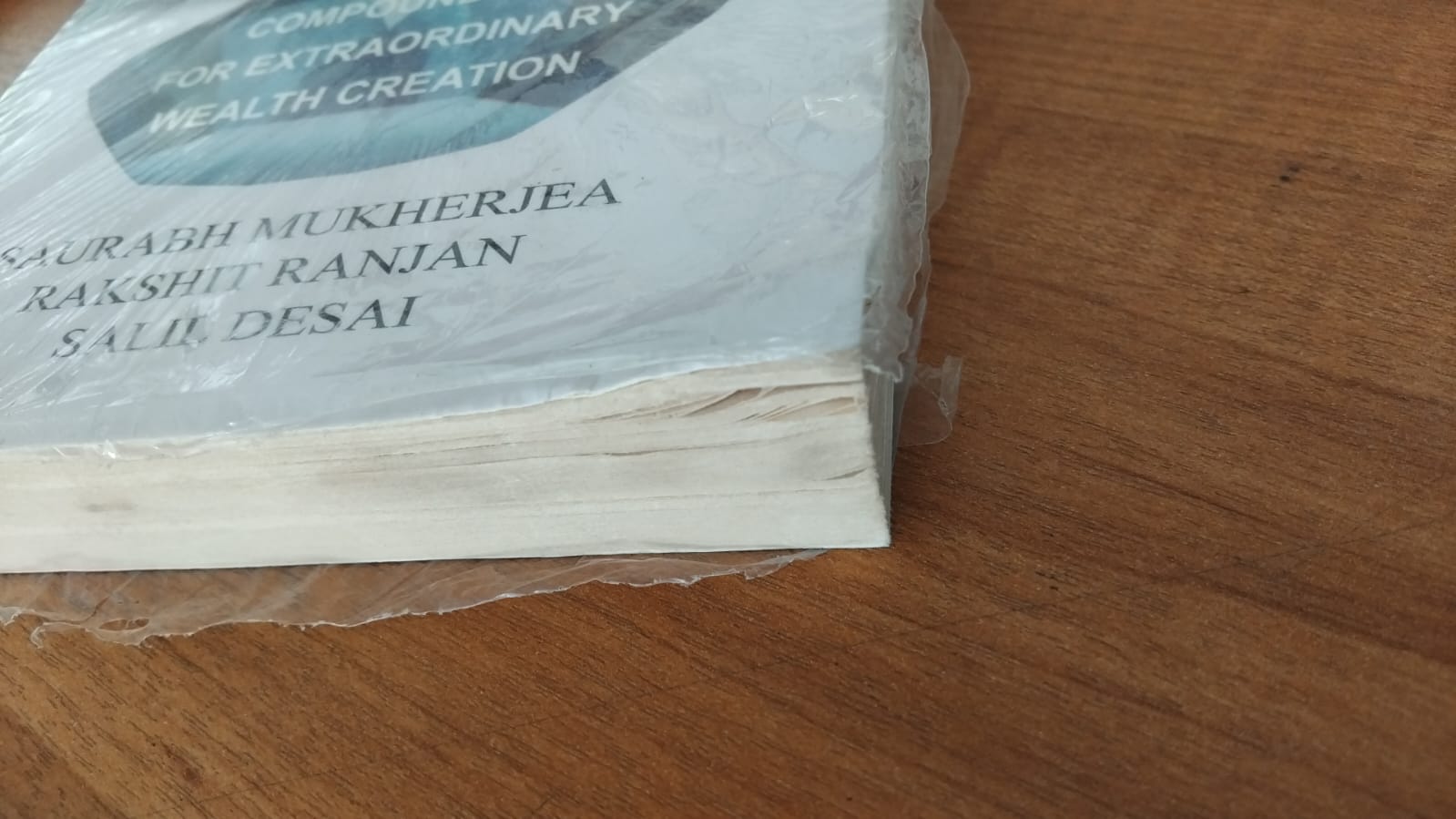

Cover bent and stain on pages |

1 in stock

Purchase & earn 13 points!Diamonds in the Dust is a powerful investing book that focuses on one timeless idea: extraordinary wealth is created not through shortcuts or speculation, but through consistent compounding in high-quality businesses. Written by Saurabh Mukherjea, Rakshit Ranjan, and Salil Desai, the book is widely regarded as one of the most insightful guides to long-term equity investing in the Indian market.

At its core, Diamonds in the Dust challenges the popular belief that successful investing requires frequent trading, market timing, or reacting to short-term news. Instead, the authors argue that true wealth creation comes from identifying exceptional companies and holding them patiently over long periods, allowing the power of compounding to work uninterrupted. This philosophy is especially relevant in an age where investors are constantly distracted by volatility and short-term performance metrics.

The book introduces the concept of “diamonds” — companies that may appear ordinary or overlooked in the short term but possess strong fundamentals that enable them to compound earnings consistently over many years. These businesses typically have clean balance sheets, strong cash flows, high return on capital, and ethical corporate governance. According to the authors, such companies often outperform flashy, high-growth stocks when held patiently.

One of the most valuable contributions of Diamonds in the Dust is its focus on quality investing. The authors emphasize that not all growth is equal. They highlight the importance of sustainable growth driven by competitive advantages rather than aggressive expansion or financial engineering. This approach encourages investors to focus on durability, resilience, and predictability rather than hype.

The book also explores the behavioral side of investing. Many investors fail to achieve long-term success not because of poor stock selection, but because of emotional decision-making. Fear during market downturns and greed during rallies often lead investors to exit quality stocks prematurely. Diamonds in the Dust stresses the importance of discipline, patience, and a long-term mindset to overcome these psychological traps.

Another key theme in the book is the role of time in wealth creation. The authors explain that compounding works best when allowed to operate over long durations. Even small differences in annual returns can lead to massive differences in wealth when compounded over decades. This reinforces the idea that consistency matters more than short-term brilliance.

The authors support their arguments with real-world examples from Indian equity markets. They analyze businesses that have delivered exceptional long-term returns by focusing on operational excellence, capital efficiency, and ethical leadership. These case studies help readers understand how theory translates into practice and make the concepts accessible even to non-expert investors.

Diamonds in the Dust also advocates for simplicity in investing. Instead of chasing hundreds of stocks or complex strategies, the authors recommend building a concentrated portfolio of high-quality businesses. This approach not only improves returns but also reduces the stress and complexity associated with constant monitoring and trading.

The book is particularly valuable for Indian investors, as it addresses the unique characteristics of India’s economy and corporate landscape. However, its principles are universal and can be applied to equity investing across global markets. Long-term compounding, quality selection, and behavioral discipline are timeless investing truths.

The writing style is clear, logical, and backed by data, making it suitable for both beginners and experienced investors. While the book is grounded in serious financial analysis, it avoids unnecessary jargon, ensuring that readers can easily grasp the core ideas.

Overall, Diamonds in the Dust is a must-read for anyone interested in long-term wealth creation through equity investing. It teaches readers to ignore noise, trust fundamentals, and allow time to do the heavy lifting. By focusing on consistency rather than excitement, the book provides a roadmap for building sustainable wealth in a disciplined and rational way.

Be the first to review “Diamonds in the Dust by Saurabh Mukherjea, Rakshit Ranjan & Salil Desai (652)” Cancel reply

Related products

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

The Forty Rules of Love Paperback – A Captivating Novel by Elif Shafak on Love and Spirituality

Uncategorized

Ego Is the Enemy by Ryan Holiday (355)

Ego Is the Enemy by Ryan Holiday (355)

Reviews

There are no reviews yet.