Subtotal: රු1,500.00

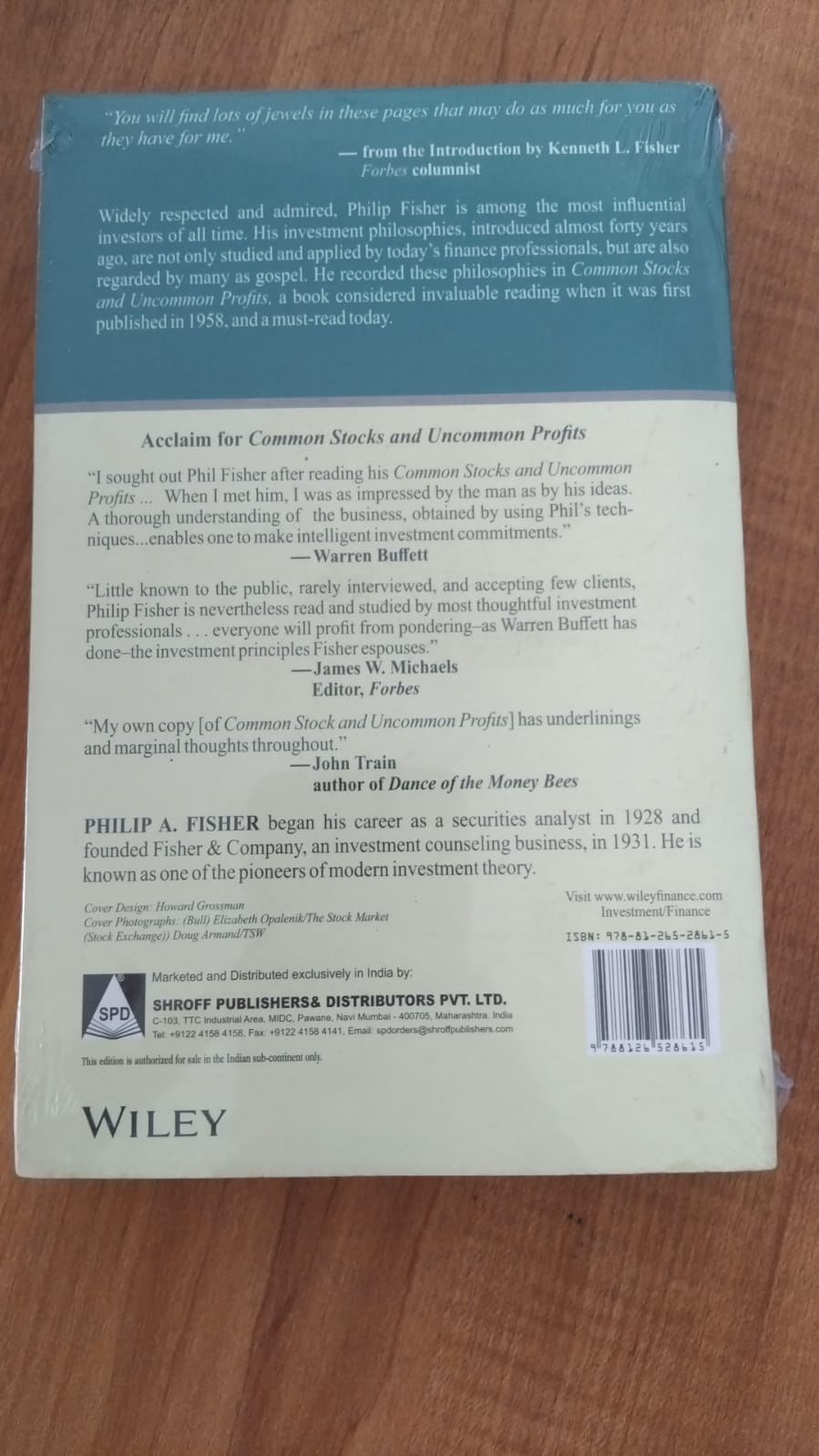

Common Stocks and Uncommon Profits by Philip Fisher (325)

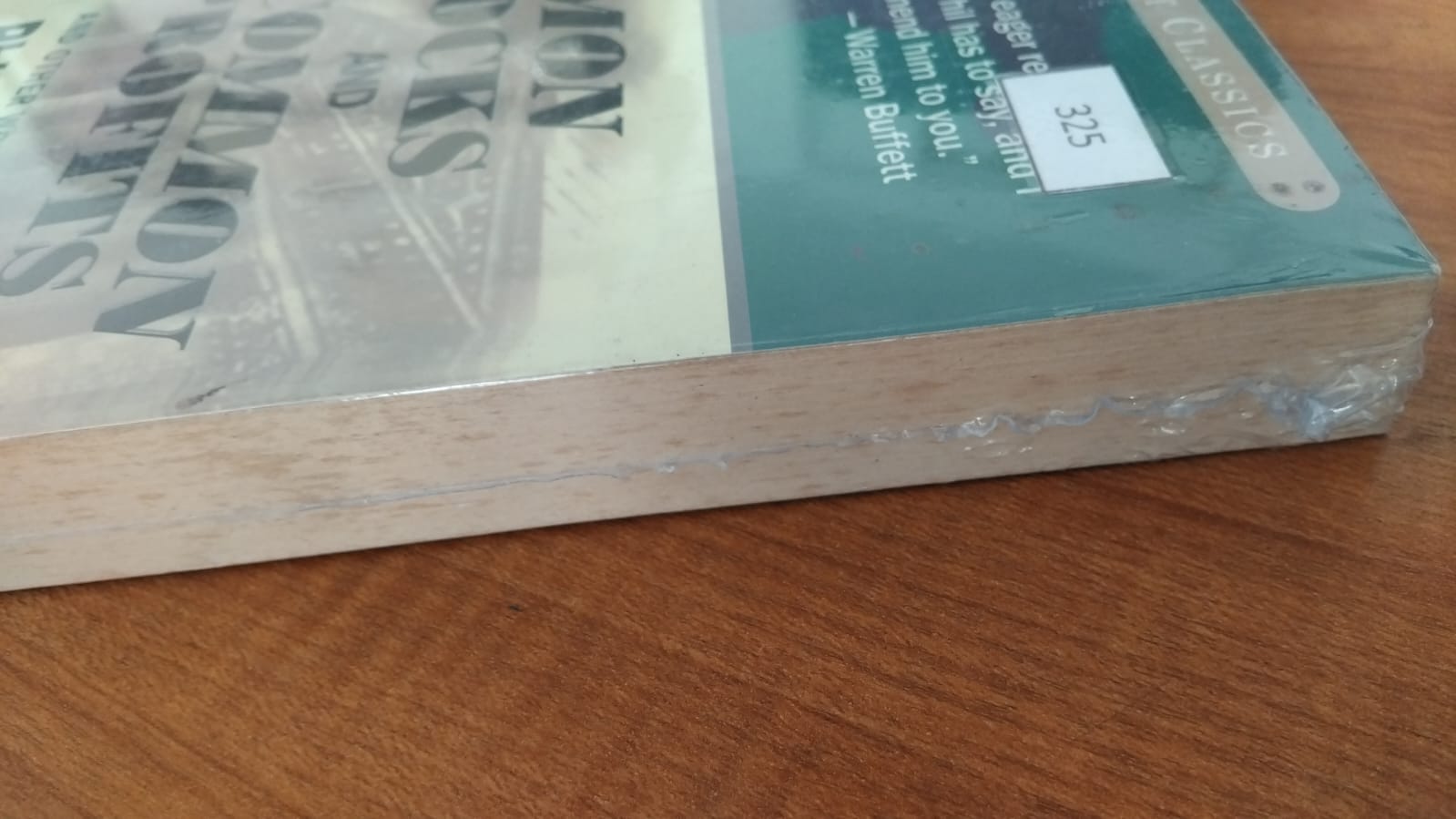

Description of Imperfection – Page Discoloration.

1 in stock

Purchase & earn 13 points!Common Stocks and Uncommon Profits by Philip A. Fisher is a classic investment book that focuses on long-term growth investing and how to identify exceptional companies with strong future potential.

First published in 1958, the book strongly influenced legendary investor Warren Buffett, who credited Fisher’s ideas for shaping his own investment philosophy.

Core Idea

The book emphasizes that investors can achieve superior returns by owning a small number of outstanding companies and holding them for the long term, rather than frequently trading or diversifying excessively.

Key Concepts and Principles

1. The “Scuttlebutt” Method

Fisher introduces a qualitative research approach called scuttlebutt, which involves gathering information from customers, competitors, suppliers, and employees to evaluate a company’s true strengths.

2. Fifteen Points to Look for in a Common Stock

Fisher outlines 15 key characteristics of superior companies, including:

-

Strong long-term growth potential

-

Innovative products or services

-

Effective research and development

-

High profit margins

-

Skilled and ethical management

-

Strong sales organization

-

Ability to maintain competitive advantage

3. Long-Term Investment Mindset

-

Buy companies with durable growth prospects

-

Hold stocks through market fluctuations

-

Avoid short-term speculation

4. When to Buy and Sell

-

Buy when a company’s prospects are strong, even if the stock seems expensive

-

Sell only if the company’s fundamentals deteriorate or management quality declines

5. Management Quality

Fisher stresses that excellent management is the most important factor in investment success.

| Author | Philip Fisher |

|---|---|

| Language | English |

| Type | Paperback Printed Book (Second Quality Copy) |

Be the first to review “Common Stocks and Uncommon Profits by Philip Fisher (325)” Cancel reply

Related products

Entrepreneurship

Biography

Damaged & Imperfect Books

Think and Grow Rich by Napoleon Hill

Think and Grow Rich by Napoleon Hill

![Stories of bible [hardcover]](https://bargainbooks.lk/wp-content/uploads/Stories-of-bible-hardcover-2-300x450.jpeg)

Reviews

There are no reviews yet.