Subtotal: රු900.00

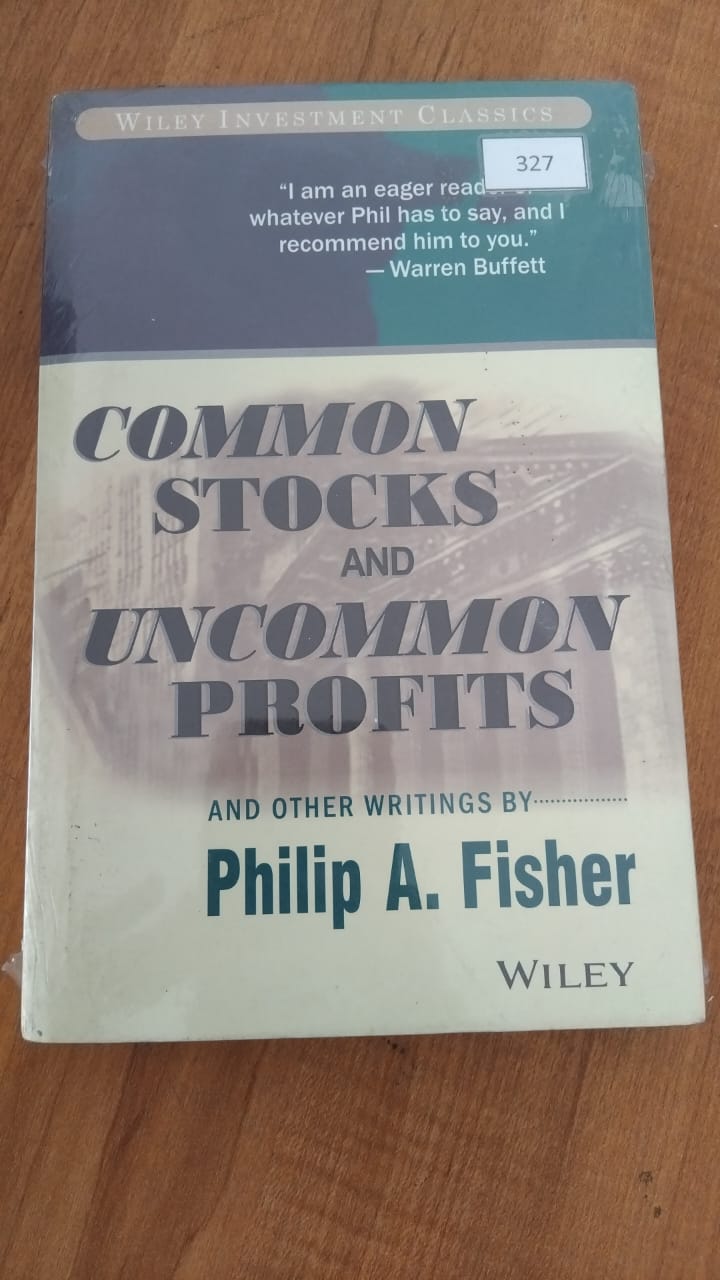

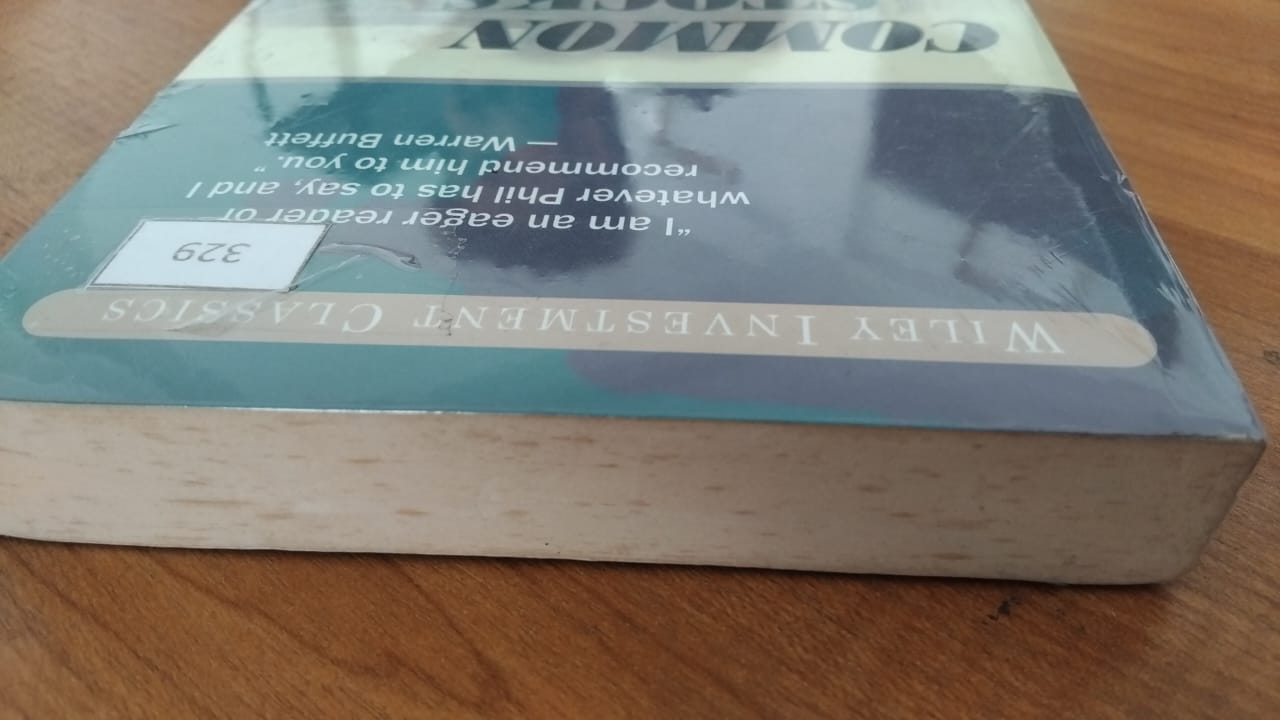

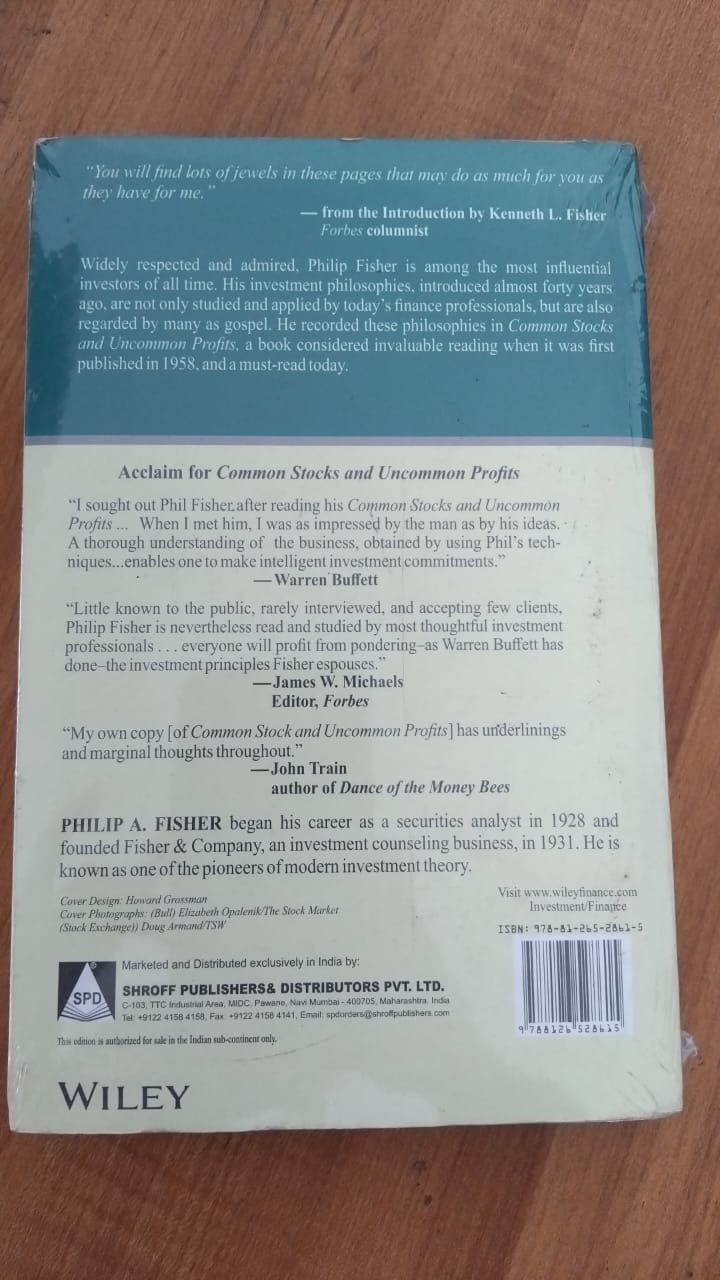

Common Stocks and Uncommon Profits by Philip A. Fisher (327)

| Pages Discoloration |

1 in stock

Purchase & earn 13 points!Common Stocks and Uncommon Profits by Philip A. Fisher is one of the most influential investment books ever written, widely regarded as a cornerstone of long-term stock investing. First published in the mid-twentieth century, the book continues to shape the thinking of modern investors, including Warren Buffett, who has publicly praised Fisher’s insights. The book focuses on identifying outstanding companies and holding them for long periods to achieve exceptional investment returns.

At the heart of Common Stocks and Uncommon Profits is Philip A. Fisher’s belief that true investment success comes from owning high-quality businesses rather than frequently trading stocks. Fisher argues that investors should think like business owners, not speculators. Instead of focusing on short-term price movements, he emphasizes understanding a company’s fundamentals, long-term growth potential, and competitive advantages.

One of the most famous contributions of Common Stocks and Uncommon Profits is the “scuttlebutt” method of research. Fisher encourages investors to gather information about a company from a wide range of sources, including customers, suppliers, competitors, and employees. This approach allows investors to gain insights into a company’s management quality, innovation, and reputation that cannot be found in financial statements alone. Fisher believed that thorough research reduces risk and improves decision-making.

The book outlines fifteen key points that investors should evaluate before buying a stock. These points cover essential factors such as the company’s research and development capabilities, profit margins, sales growth, management integrity, and long-term vision. Fisher stresses that companies with strong leadership and a commitment to innovation are more likely to deliver sustained growth over time.

Management quality is a central theme throughout Common Stocks and Uncommon Profits. Fisher believed that even a great product or market position could be undermined by poor leadership. He advises investors to look for management teams that are honest, competent, forward-thinking, and focused on long-term success rather than short-term gains. According to Fisher, great management is one of the most valuable assets a company can possess.

Another important lesson from the book is the value of patience. Fisher strongly discourages frequent buying and selling of stocks. He argues that once an investor has identified an outstanding company, the best strategy is often to hold it through market fluctuations. Long-term ownership allows investors to benefit from compounding growth and reduces the emotional mistakes that come with market timing.

Common Stocks and Uncommon Profits also addresses the concept of risk in investing. Fisher explains that real risk is not volatility, but the possibility of permanent loss due to poor business fundamentals. By deeply understanding the companies they invest in, investors can reduce risk and make more confident decisions during periods of market uncertainty.

The book also discusses diversification, advising investors not to over-diversify. Fisher believed that holding too many stocks prevents investors from truly understanding each business. Instead, he supported owning a focused portfolio of carefully selected companies with strong growth prospects. This disciplined approach encourages quality over quantity.

Philip A. Fisher’s writing style is clear, practical, and grounded in real-world experience. The principles outlined in Common Stocks and Uncommon Profits are not tied to any specific market condition, making the book relevant across generations. Its ideas complement value investing philosophies and have influenced some of the most successful investors in history.

The lasting impact of Common Stocks and Uncommon Profits is evident in how it reshaped investment thinking. Warren Buffett later combined Fisher’s focus on quality businesses with Benjamin Graham’s value principles, creating a powerful investment strategy. This legacy underscores the importance of Fisher’s work.

Common Stocks and Uncommon Profits is ideal for investors who want to move beyond short-term trading and build wealth through disciplined, long-term investing. It is especially valuable for readers interested in fundamental analysis, business quality, and sustainable growth.

Overall, Common Stocks and Uncommon Profits by Philip A. Fisher is a timeless guide to intelligent investing. It teaches that exceptional returns come from careful research, patience, and investing in outstanding companies. The book remains a must-read for anyone serious about understanding how to invest wisely and build long-term financial success.

Be the first to review “Common Stocks and Uncommon Profits by Philip A. Fisher (327)” Cancel reply

Related products

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

Damaged & Imperfect Books

21 Lessons for 21st Century by Yuval Noah Harari (288)

21 Lessons for 21st Century by Yuval Noah Harari (288)

Reviews

There are no reviews yet.