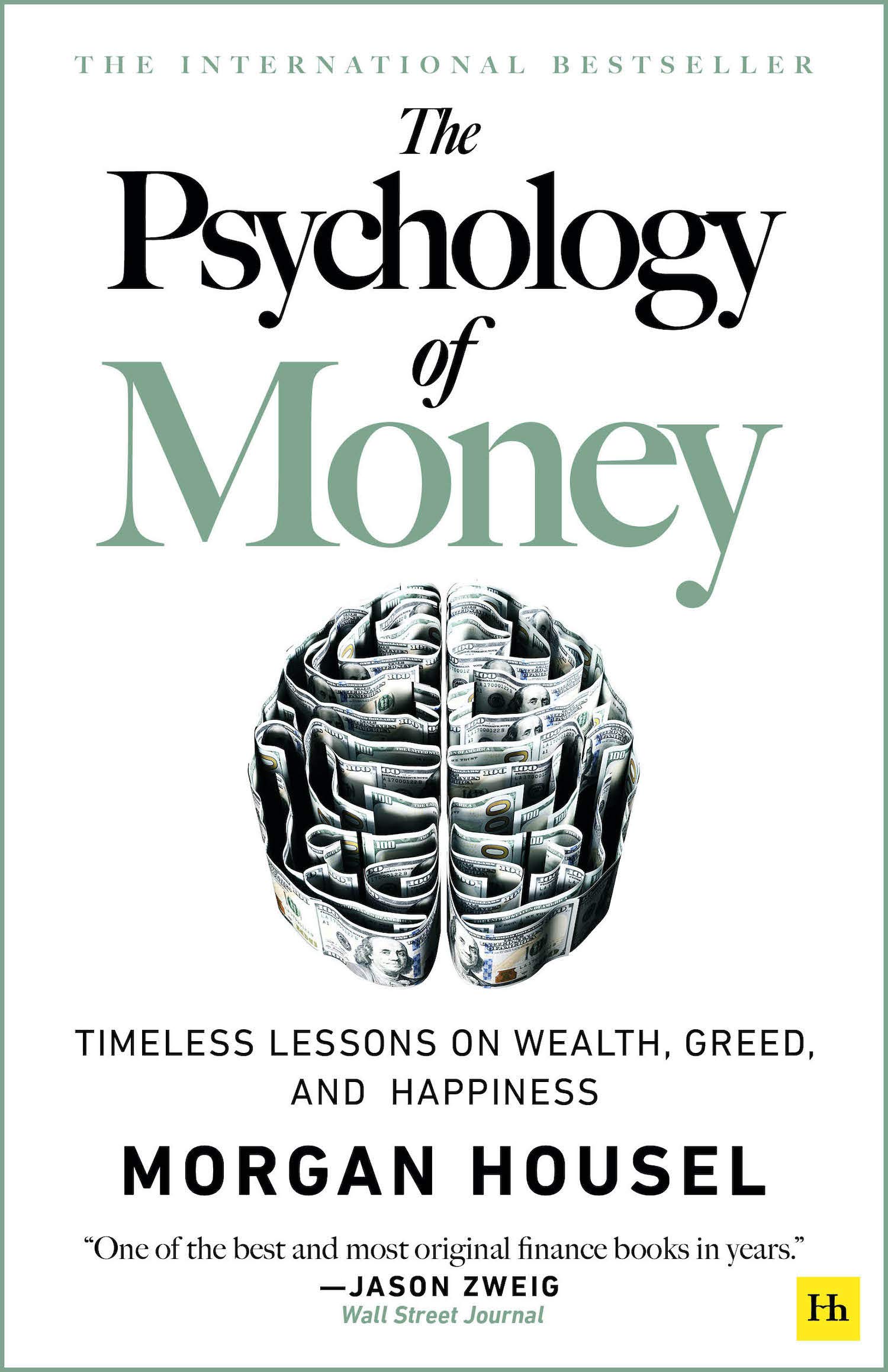

Psychology of Money by Morgan Housel

“The Psychology of Money” by Morgan Housel offers a unique exploration of the complex relationship between money and human behavior. Through engaging anecdotes and insightful observations, Housel delves into how emotions, decisions, and psychological factors shape our financial habits, offering timeless lessons on wealth, happiness, and financial success.

6 in stock

Purchase & earn 17 points!“The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” by Morgan Housel is a thought-provoking book that examines the often-overlooked psychological aspects of money and finance. Instead of focusing solely on numbers and formulas, Housel explores how human behavior, emotions, and decision-making play a crucial role in our financial lives. Through a series of 20 short stories, he illustrates how money is influenced more by psychology than by logic, offering readers valuable insights into the way we think about wealth, risk, and financial success.

Housel’s approach is rooted in real-life examples and anecdotes that bring to life the principles of behavioral finance. He challenges conventional wisdom and reveals how our upbringing, experiences, and biases impact our financial decisions, often in ways we might not expect. The book is both accessible and profound, making complex financial concepts understandable and relatable to readers from all walks of life.

Key Features of “The Psychology of Money” by Morgan Housel:

Behavioral Insights: Housel delves into the psychological factors that influence financial decisions, such as fear, greed, and ego. He explains how these emotions can lead to irrational behavior and poor financial choices, offering strategies for overcoming these tendencies.

Real-Life Examples: The book is filled with anecdotes and stories that illustrate key financial principles. Housel uses examples from history, business, and personal experiences to demonstrate how people have succeeded or failed based on their understanding of money psychology.

Timeless Lessons: Housel’s insights are designed to be timeless, applicable in any economic environment. He emphasizes that wealth is not just about earning more money but about managing it wisely and understanding the psychology behind financial decisions.

Accessible Writing: Housel’s writing style is clear, engaging, and free of jargon, making the book accessible to a wide audience. Whether you’re a seasoned investor or just starting to think about your finances, “The Psychology of Money” provides valuable lessons in an easy-to-understand format.

Focus on Long-Term Thinking: The book encourages readers to think long-term about their financial decisions, highlighting the importance of patience, perseverance, and avoiding short-term thinking in wealth building.

Cultural and Historical Perspectives: Housel draws on a wide range of cultural and historical examples to illustrate how different societies and individuals have approached money. These perspectives offer a broader understanding of the role of money in our lives.

Personal Finance Wisdom: Beyond just investing, the book offers practical advice on managing personal finances, such as saving, spending, and planning for the future. Housel emphasizes the importance of aligning financial decisions with personal values and goals.

Thought-Provoking Concepts: Housel introduces readers to new ways of thinking about money, such as the idea that financial success is often more about behavior than knowledge. He challenges readers to reconsider their approach to money and to adopt healthier financial habits.

Critical Acclaim: “The Psychology of Money” has been widely praised for its insightful and practical approach to personal finance. It has resonated with readers and critics alike for its ability to make complex financial ideas accessible and relevant.

Broad Appeal: The book appeals to a diverse audience, including investors, entrepreneurs, and anyone interested in improving their financial literacy. Its blend of psychology and finance makes it a unique and valuable resource for understanding the true nature of money.

Practical Takeaways: Each chapter concludes with key takeaways that summarize the main points, allowing readers to easily apply the lessons to their own financial lives.

“The Psychology of Money” by Morgan Housel is an essential read for anyone looking to understand the deeper forces at play in their financial decisions. Whether you’re aiming to build wealth, achieve financial independence, or simply improve your relationship with money, Housel’s insights provide a fresh and valuable perspective. This book is not just about how to manage money; it’s about understanding why we manage it the way we do and how to do it better.

| Weight | 0.224 kg |

|---|---|

| Dimensions | 14.2 × 0.9 × 21.7 cm |

| Author | Morgan Housel |

| Language | English |

| Type | Paperback Printed Book (Second Quality Copy) |

| ISBN/ISSN | 9390166268 |

| Pages | 252 |

Be the first to review “Psychology of Money by Morgan Housel” Cancel reply

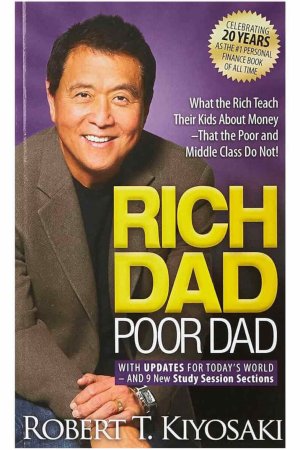

Related products

Self-Help

Non-fiction

Non-fiction

Non-fiction

Self-Help

Reviews

There are no reviews yet.